Understanding the value of gold: Prices, global reserves, and market trends

Interest in gold has skyrocketed in recent weeks, with the price of one ounce hitting an all time high of $5,600 on January 29 before settling back to just under $5,000 on Sunday.

As economic conditions fluctuate and geopolitical tensions rise, more individuals are seeking gold as a secure investment.

How is the value of gold measured?

Understanding the value of a gold item requires knowing its weight in troy ounces alongside its purity in karats.

Weight (in troy ounces)

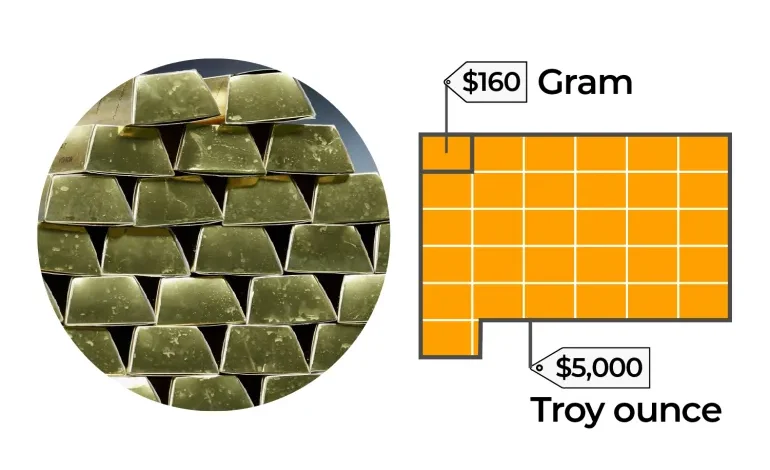

The weight of gold and other precious metals like silver and platinum is commonly measured in troy ounces (oz t). One troy ounce is equal to 31.1035 grammes.

At $5,000 per troy ounce, 1 gramme of gold is worth about $160, and a standard 400-troy-ounce (12.44kg) gold bar costs $2m.

Troy ounces are different from regular ounces, which weigh 28.35 grammes and are used to measure everyday items including foods.

Purity (in karats)

Karat or carat (abbreviated as “K” or “ct”) measures the purity of a gold item. Pure gold is 24 karats, while lower karats such as 22, 18, and 9 indicate that the gold is mixed with less expensive metals like silver, copper, or zinc.

To determine the purity of gold, jewellers are required to stamp a number onto the item, such as 24K or a numeric value like 999, which indicates it is 99.9 percent pure. For example, 18K gold will typically have a stamp of 750, signifying that it is 75 percent pure.

Some typical values include:

24 karat – 99.9% purity – A deep orange colour, is very soft, never tarnishes and is most commonly used for investment coins or bars

22 karat – 91.6% purity – A rich orange colour, moderate durability, resists tarnishing and most often used for luxury jewellery

18 karat – 75% purity – A warm yellow colour, high durability, will have some dulling over time and most often used in fine jewellery

9 karat – 37.5% purity – A pale yellow colour, has the highest durability, dulls over time, used in affordable jewellery

Other karat amounts such as 14k (58.3% purity) and 10k (41.7% purity) are often sold in different markets around the world.

When you buy jewellery, the price usually depends on the day’s gold spot price, how much it costs to make, and any taxes.

If you know the item’s exact weight in grammes and the gold’s purity in karats, you can calculate the craftsmanship cost on top of that.

You typically cannot negotiate the spot gold price, but you can often haggle over the craftsmanship costs.

The price of gold has quadrupled over the past 10 years

Gold has been valued for thousands of years, serving various functions, from currency to jewellery. The precious metal is widely regarded as a safe haven asset, particularly in times of economic uncertainty or market volatility.

Up until 1971, the United States dollar was physically defined by a specific weight of gold. Under the classical gold standard, for nearly a century, from 1834 until 1933, you could walk into a bank and exchange $20 for an ounce of gold.

In 1933, amid the Great Depression, the price was raised to $35 per ounce to stimulate the economy.

In 1971, under President Richard Nixon, gold was decoupled from the dollar, and its price began to be determined by market forces.

Over the past 10 years, the price of gold has quadrupled from $1,250 in 2016 to around $5,000 today.