Dubai-based Tabby raises $58 million in funding round, valued at $660 million

Dubai-based Tabby raised $58 million from investors including Sequoia Capital India in a funding round that valued the buy now, pay later startup at almost $700 million.

PayPal Ventures also took part in the Series C capital fundraising, along with Mubadala Investment Capital, Saudi venture capital firm STV, Arbor Ventures and Endeavor Catalyst, Tabby said in a statement. The round valued Tabby at $660 million.

“As we continue to scale, the valuation should continue to follow,” Chief Executive Officer Hosam Arab said in an interview. “We’re not fixated on any particular number or on any particular titles.”

Tabby will use the funds to expand its product offering and support its expansion plans, Arab said.

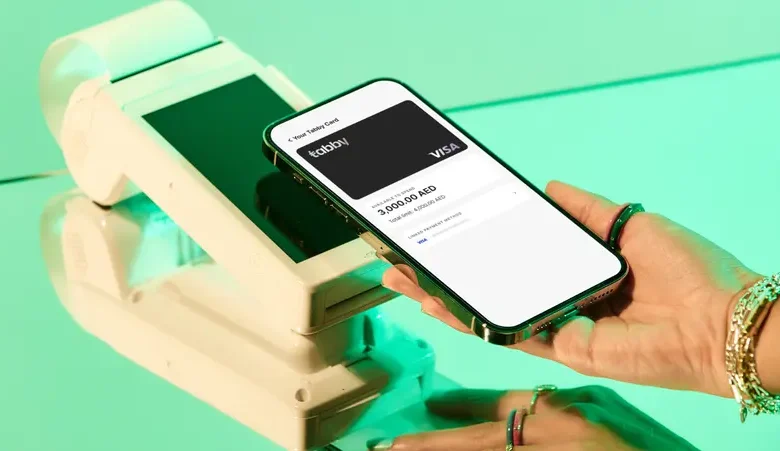

Firms like Tabby allow customers to purchase goods and pay for them in installments. Regionally, it operates in Saudi Arabia, the UAE, Egypt and Kuwait, and competes with firms including Tamara. The potential for the buy now, pay later sector in the region is for about 150 million customers, leaving room for Tabby to grow its 3 million active users, Arab said.

Record Year

Arab said he may also explore the possibility of taking Tabby public.

Offerings on the Gulf region’s stock exchanges have been booming amid a push by countries like the United Arab Emirates and Saudi Arabia to deepen their capital markets. “It is something that is potentially in the works once optimism does return to the markets,” the CEO said.

Venture capital markets in the Middle East and North Africa had a record year of funding last year, according to a report from Dubai-based research firm Magnitt, even as other emerging markets struggled with tighter liquidity due to rising interest rates.

While concerns over higher interest rates and a looming recession have impacted buy now, pay later companies in developed markets, consumers in the Gulf are less indebted and are better-able to repay debts, Arab said.

Tabby is also on the look out for potential merger and acquisition targets and expects opportunities to grow in the coming months.

“We predict that these opportunities will become a lot more available over the remainder of this year as funding continues to dry up and startups that haven’t raised funds in the last 12 months are in positions where they need access to capital,” Arab said.