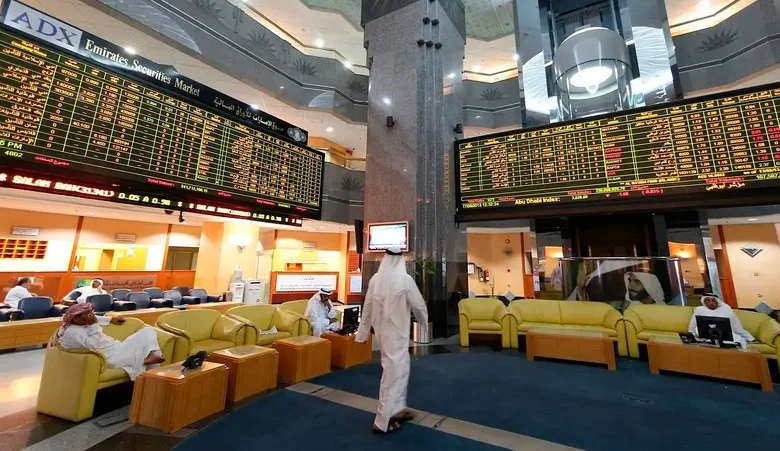

Abu Dhabi’s Lunate partners with JPMorgan for first UAE bond ETF

Abu Dhabi-based Lunate Capital Limited has partnered with JPMorgan Chase & Co. to build the first exchange-traded fund tracking the performance of bonds in the United Arab Emirates.

The Chimera JPMorgan UAE Bond UCITS ETF will list on the Abu Dhabi Stock Exchange on March 26.

It aims to replicate the performance of the J.P. Morgan MECI UAE Investment Grade Custom Index, which tracks the performance of liquid, dollar-denominated debt instruments from issuers based in the UAE.

The index includes investment-grade bond issuances with at least $500 million in face amount outstanding, such as those from Mubadala Investment Co PJSC, the Emirate of Abu Dhabi, the UAE government, First Abu Dhabi Bank PJSC, Abu Dhabi National Energy Co. and the Investment Corporation of Dubai.

Dividends received by the ETF will be distributed in June and December, when available. The indicative yield to maturity of the index is 5.4 percent as of March 7.

The initial offering period is from March 14 to 20. The offering price is set at 3.67 dirhams ($1).

There are only a few ETFs tracking Middle Eastern fixed-income markets, and Lunate’s fund will be the first to offer exposure to UAE bonds.

Abu Dhabi’s sovereign debt is rated at the third-highest investment grade by the three major ratings companies.

Bloomberg has reported that the emirate is looking to tap international debt markets soon.