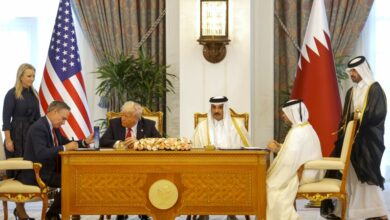

LVMH is shifting out of Hong Kong as luxury shoppers stay home

LVMH is shifting resources out of Hong Kong, reflecting waning interest in what used to be Asia’s premium shopping hub as mainland Chinese consumers switch to shopping at home.

The top global luxury conglomerate wants to focus more of its investment in burgeoning metropolises such as Shanghai, Chengdu, Guangzhou and Shenzhen as Hong Kong loses its relevance in the Greater China region, according to people familiar with the matter, who asked not to be identified discussing private deliberations.

To that end, it’s already moved the regional headquarters of some brands, including the group’s local head office, to Shanghai, and relocated some senior executives to the mainland, the people said.

A spokesperson for LVMH Moet Hennessy Louis Vuitton SE declined to comment and pointed to the company’s recent earnings announcements.

The financial hub has long been a luxury shopping mecca for mainland tourists drawn in by its lower prices and broader array of product offerings.

But fortunes took a turn in 2019, when months of anti-government protests kept many visitors away, while the pandemic dealt an even bigger blow with China sealing itself off from the world as part of COVID Zero. Devoid of shoppers, major retailers began shutting stores across Hong Kong’s glitziest retail strips.

Sales slump

For LVMH, which owns brands including Louis Vuitton, Christian Dior and Tiffany & Co., the post-COVID recovery has been much slower in Hong Kong than elsewhere in Greater China, according to one of the people.

The company expects the pivot by Chinese shoppers to buying more domestically to continue, with the portion of total luxury spending that’s done within the mainland expected to almost double from pre-COVID levels, one of the people said.

The conglomerate doesn’t break down Greater China sales figures by location in its public results.

LVMH is already reaping the benefits of China’s reopening to the world, with a rush of shoppers unleashing a massive wave of spending that boosted sales and pushed shares to a record this month.

The country’s bullish longer-term prospects have made moving closer to the major growth market increasingly attractive, and some of the biggest names in luxury have already been expanding their presence in the mainland.

That’s spurred the rise of shopping centers like the duty-free island of Hainan and the gambling hub of Macau, which are likely to further erode Hong Kong’s significance.

Duty-free sales in Hainan more than tripled to 49.5 billion yuan ($7.2 billion) in 2021 from 2019, according to Bloomberg Intelligence analysts Angela Hanlee and Rebecca Wang.

Even during last year’s COVID Zero chaos, sales were still more than twice the size of pre-pandemic levels, and the island province is well-positioned to benefit from policies to boost onshore spending in China, they said.

Hong Kong’s neighbor, Macau, is also emerging as an up-and-coming luxury destination able to offer cheaper prices as well as a broader holiday experience for mainland Chinese tourists.

The gambling hub’s visitor arrivals recovered to about 62 percent of 2019 levels over this month’s Easter holiday — versus 44 percent for Hong Kong — building on a tourism boom during January’s Lunar New Year break.