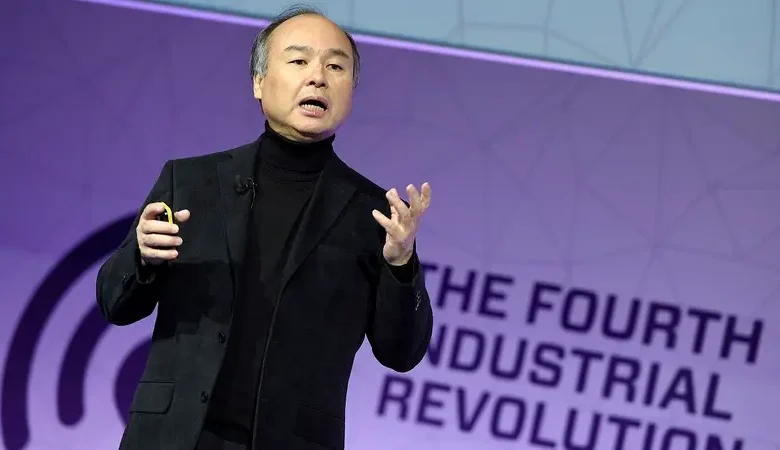

SoftBank’s Masayoshi Son adds $4 bln to his wealth on Arm’s 192 pct rally

Masayoshi Son has added about $3.8 billion to his net worth this year as the surging stock price of Arm Holdings Plc bolsters the value of his holdings in SoftBank Group Corp.

The pace of increase in his wealth puts the Japanese billionaire in the top 30 gainers among the world’s 500 richest people tracked by the Bloomberg Billionaires Index. The 66-year-old founder of SoftBank Group was worth $15.1 billion as of Tuesday, compared with $11.3 billion at the end of last year.

Son is personally benefiting from Arm’s rally because he owns roughly a third of SoftBank Group, which holds 90 percent of the UK chip designer. Arm extended its three-day rally to 90 percent after its earnings report last week showed AI spending is boosting sales. The stock has now almost tripled from its initial public offer-ing price of $51. SoftBank shares are trading near a three-year high.

“As long as its assets hold up their gains, people are not going to say SoftBank is over priced,” said Masahiro Yamaguchi, senior market analyst at SMBC Trust Bank Ltd. “For Arm, the stock surge may look overheated but if you think this will be backed by solid earnings growth in the future, it doesn’t feel out of place.”

Arm gave a bullish forecast when it reported financial results last week, suggesting the company can push beyond its traditional smartphone business into artificial intelligence and other promising markets. Yamaguchi said investors are likely to take cues from Nvidia Corp.’s earnings next week to gauge whether the latest gains have been excessive.

To Victor Galliano, an independent analyst who publishes on Smartkarma, Arm’s current level prices a “super-premium” as Nvidia trades on less than half the prospective earnings multiple for a very similar forward earnings-per-share growth. Kirk Boodry of Astris Advisory also notes Arm’s multiples are already “eye-wateringly rich.”

SoftBank shares continue to trade at a significant discount to its net asset value as the Vision Fund unit accounts for a chunk of the technology investors total holdings. The second Vision Fund remains mired in losses after a post-pandemic slump hurt tech valuations worldwide. Galliano estimates the two Vision Funds to account for about 25.3 percent of NAV, while Arm accounts for a whopping 48.4 percent.

Son remains personally on the hook for about $5.3 billion on side deals he set up at SoftBank Group to boost his compensation, according to Bloomberg calculations based on company disclosures. Portfolio losses linked to the Vision Fund 2 stood at $2.9 billion, and $556 million for the Latin America fund, according to disclosures for the December quarter. His remaining deficit at SB Northstar was ¥259.7 billion ($1.8 billion).

The billionaire holds 17.25 percent of a vehicle set up under Soft-Bank’s Vision Fund 2 for its unlisted holdings, as well as 17.25 percent of a unit within the company’s Latin America fund, which also invests in startups. He indirectly holds a 33 percent stake in SB Northstar, a vehicle set up at the company to trade stocks and derivatives.

The Vision Fund 2 is the second-largest contributor to SoftBank’s equity value — accounting for about 14 percent — and any mark downs pose a risk, Galliano wrote in a note published on Smart-karma. “A radical, positive shift in the fortunes of the SVF2 holdings is needed to lower Masa’s IOUs with Softbank, which seems unlikely, in our view,” he wrote.