Ozempic maker’s obesity-fueled share gains seen slowing after banner year

A frenzy around obesity drugs made Novo Nordisk A/S Europe’s biggest stock-market success story of 2023. Repeating the trick won’t be so easy.

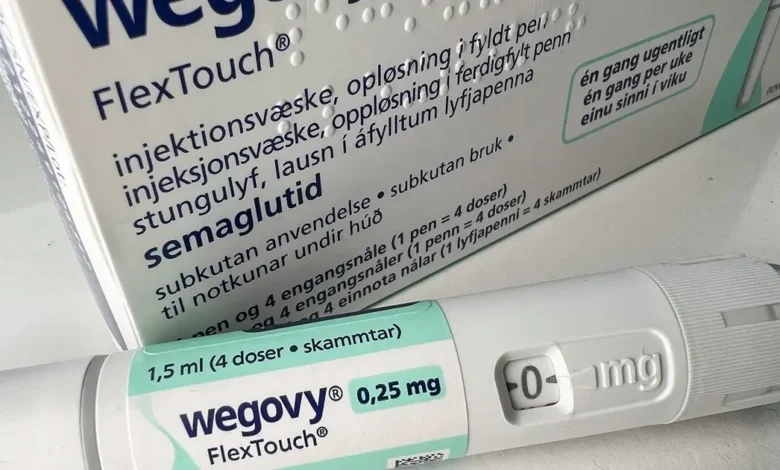

Shares of Novo, which makes the diabetes drug Ozempic and weight loss medicine Wegovy, have risen 42 percent this year, as investors latched on to the growth potential of a market that some analysts predict could reach $100 billion by 2030. The rally made it Europe’s biggest company and pushed the Danish firm’s value past the size of its domestic economy.

But 2024 is a different ball game. Analysts see just 9 percent upside on average in the next 12 months, while about one-third of respondents to Bloomberg’s recent Markets Live Pulse survey expect weight-loss stocks to become laggards next year. Among Novo’s challenges: rising competition, issues with producing enough of its blockbuster drugs, and a valuation that’s getting stretched.

“They’re an excellent R&D company and they’re very well man-aged, but too much is priced in,” said Nick Cameron, a portfolio manager at Antipodes Partners, which doesn’t own Novo. “We can’t make the valuation work at these levels.”

The comments echo those of GAM Investments director Niall Gallagher, who cut his holdings of the stock amid the “hype surrounding the class of drugs known as GLP-1 receptor agonists.”

Novo trades at about 30 times analysts’ estimated earnings for the next 12 months, more than double the valuations of European big pharma peers like Roche Holding AG and Sanofi. Still — they’re cheaper than shares in Eli Lilly & Co., the maker of rival drugs Mounjaro and Zepbound, which trade at about 46 times projected earnings.

“A lot of people are talking about whether Lilly and Novo have run their course,” said Ailsa Craig, co-lead manager of the International Biotechnology Trust. “Have the huge sales numbers been factored into their valuations now and is it sort of a bubble? That’s a big debate.” The IBT doesn’t hold shares in Novo or Lilly.

Novo is set to maintain its dominance of the market in 2024, ac-cording to Bloomberg Intelligence. But more competition is looming: Zepbound, which is cheaper than Wegovy, is now available in US pharmacies and is expected to get European authorization early next year. Other companies are also getting in on the action, with Zealand Pharma A/S and partner Boehringer Ingelheim undertaking late-stage trials on their own asset, and data due next year on an obesity pill made by Amgen Inc.

But even if things get more challenging, many think Novo’s overall trajectory remains positive.

“The potential for weight-loss drugs is still very big as currently they are only prescribed to a tiny portion of the eligible patient population,” said Gregoire Biollaz, senior investment manager at Pictet Asset Management. The company can reinvest its cash to defend its leading position in the market, he added.

A new catalyst could propel the shares to even-greater heights. There are early signs that GLP-1 drugs could help with a wide range of ailments, including addiction and even Alzheimer’s disease. Novo’s next-generation obesity drug, CagriSema, is in advanced clinical trials, and has the potential to help patients shed as much as 25 percent of their body weight. The company has also said that it is hunting for deals to beef up its pipeline.

Ripple effects

Intron Health analyst Naresh Chouhan sees several reasons for more upside. Wegovy prescriptions covered by Medicaid are an under-appreciated opportunity which could be worth as much as $6 billion to the company, while the use of Ozempic to treat kidney failure may also be a catalyst, he said.

Whatever happens with Novo, it’s likely to have an impact on a multitude of other industries — from grocery giants like Walmart Inc., which has said it’s seeing the medications impact demand for food, to consumer staples firms like Nestle SA, which is working on products to complement weight loss. Exercise-related stocks, medical device companies and other drugmakers may also see ripple effects.

But for some, this year’s excitement around Novo is losing steam, particularly as strategists are predicting a muted performance for the broader European market in 2024. There are few key catalysts for Novo over the next 12 months, Jefferies analyst Peter Welford wrote in a recent note, reiterating an underperform rating. “We envisage sentiment to change.